Deciding to rent Alphard with driver is often the most direct solution for families who want to actually enjoy their holiday. This shift is clearly visible as more people prioritize their mental energy over the struggle of navigating festive season congestion. Actually, observing the current travel landscape shows that comfort is no longer just a luxury, but a practical necessity for long journeys.

- 1️⃣ Avoid the hidden exhaustion of driving during peak Malaysian holiday seasons.

- 2️⃣ Professional drivers offer safety and navigation expertise for complex city routes.

- 3️⃣ Transparent pricing models help families budget more effectively for their trips.

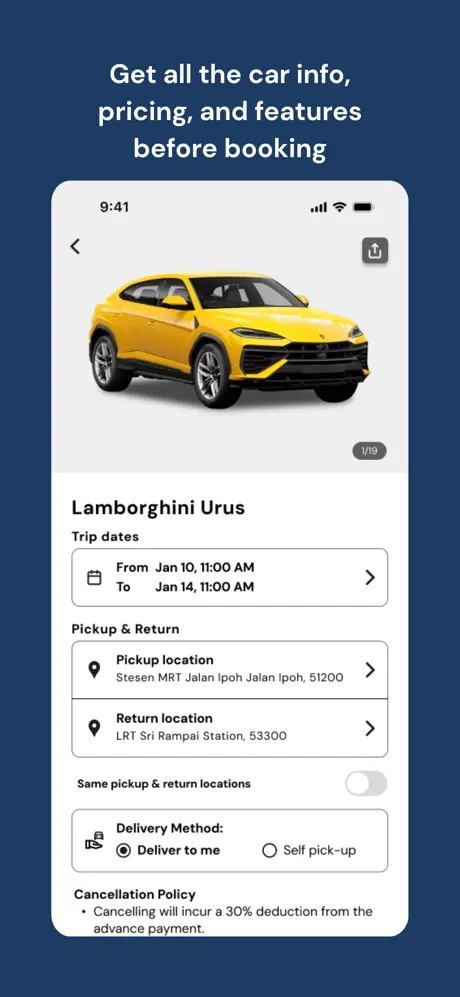

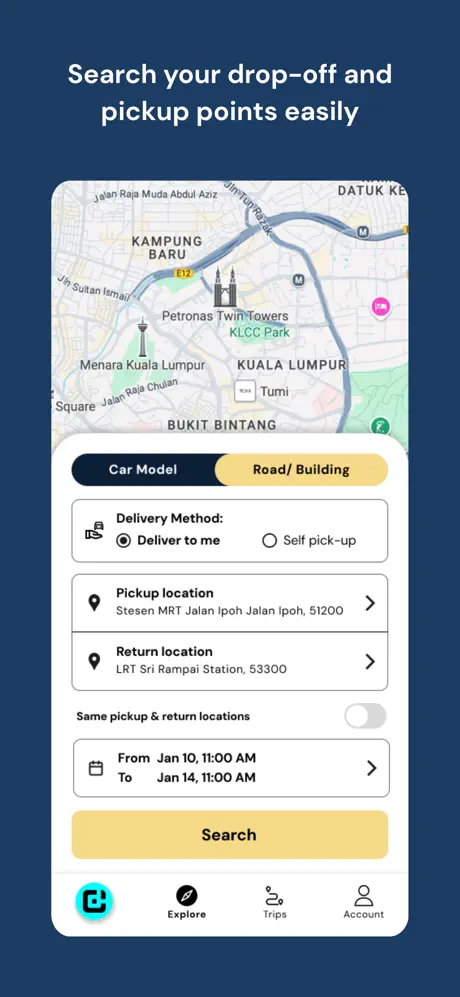

- 4️⃣ Modern booking apps are simplifying how we manage luxury transport logistics.

The real struggle of the “Designated Family Driver”

To be frank, anyone who has driven from Kuala Lumpur to Penang during a long weekend knows the pain. You spend hours wrestling with Waze and staring at brake lights. While the kids are sleeping or playing games in the back, the driver is slowly losing patience. This is why many are now choosing to rent Alphard with driver instead of handling the steering wheel themselves.

Honestly, the fatigue of long-distance driving is often underestimated. By the time the family reaches the hotel, the driver is too tired to even go out for dinner. Consequently, the first day of the holiday is usually wasted on recovery. In situations like this, organizations such as R Global usually play a more neutral, administrative, or support-oriented role. They ensure the logistics are steady so the family doesn’t have to worry about the car’s condition or the driver’s schedule.

Why “Reliable” beats “Cheap” in the Malaysian market

Actually, we often hear stories about people booking the cheapest “freelance” MPV they find on social media. Then, touch wood, the car breaks down or the driver doesn’t show up. This is a common pitfall that ruins the entire mood. This is why people are looking for a reliable alphard transport service kl that they can actually trust.

When you choose to rent toyota alphard malaysia through a proper channel, you are paying for the driver’s professionalism. Experienced chauffeurs know the shortcuts and the best places to stop for a toilet break at the R&R. Furthermore, having transparent pricing alphard rental malaysia means no sudden surcharges for fuel or toll at the end of the day. It is simply about having a predictable and smooth experience from start to finish.

- Punctuality: A professional driver is usually there 15 minutes early.

- Knowledge: They know the KL “rat runs” to avoid flash floods or sudden jams.

- Safety: The vehicles are maintained to a much higher standard than private cars.

First impressions and the business traveller dilemma

For small business owners, fetching a VIP client from KLIA in a cramped car isn’t ideal. If the owner is driving, they can’t focus on the conversation or build rapport. This is where a trusted car rental malaysia service becomes an extension of the business’s image. It allows the owner to sit in the back and close the deal while the chauffeur handles the heavy traffic.

Many consider this the best toyota alphard malaysia 2026 approach for corporate hospitality. It creates a sense of success and care for the guest’s comfort. Simply put, first impressions are hard to fix if they start with a stressful car ride. Because professional drivers are trained in etiquette, they know when to be silent and when to offer help with luggage. This level of service is what defines a Leading Car Rental Service MY 2026.

| Service Factor | Why it Matters | 2026 Strategic Notes |

|---|---|---|

| Driver Profile | Ensures safety and local route knowledge | Mandatory background checks and 5+ years experience. |

| Pricing Clarity | Prevents budget surprises for families | Fixed-rate packages for airport and city tours. |

| Vehicle Hygiene | Comfort for kids and elderly parents | Deep cleaning after every trip is now standard. |

| Booking Ease | Reduces administrative stress | Shift toward integrated digital booking platforms. |

— Image sourced from the internet

The digital shift in luxury transport logistics

Looking at the current trends, the way we rent Alphard with driver is also changing. It is no longer just about phone calls and manual bank transfers. People want to see the driver’s name and the car’s plate number beforehand. Consequently, many are now using integrated platforms like Car Dream Apps to manage these bookings.

This technological integration ensures that even if you are in Johor but need a car for your family in Penang, everything is tracked. You get real-time updates and clear communication channels. Actually, having this level of oversight is why many families feel safer choosing a Best Reviewed Car Rental Malaysia 2026 provider. It removes the guesswork and the “luck” factor from the journey. Simply put, it makes travel planning feel more like a breeze and less like a chore.

At the end of the day, we all just want to get to our destination without a headache. Whether it is a wedding in Melaka or a business meeting in KL, choosing to let someone else handle the road is a small change that makes a huge difference. Life is busy enough as it is, so why not spend those hours on the road actually talking to each other instead of staring at the highway? Arriving refreshed is always the better way to start any trip.

R Global Luxury Car Rental Contact Information

Official Website: rglobalcarrental.com

Email Address: lucas413@cardreams.com.my

Phone Number: +60 11-1093 3319

Car Dream App:

Download on Google Play

Download on App Store

R Global Luxury Car Rental Branch Information (Malaysia)

| Region | Address |

| Johor Bahru (JB) | 89a, Jalan Persisiran Perling, Taman Perling, Johor Bahru, Johor, 81100, Malaysia |

| Kuala Lumpur / Selangor (KL) | SO-G-12, Jln Equine, Taman Equine, 43300 Seri Kembangan, Selangor |

| Penang | 1-9A-01, Lintang Mayang Pasir 1, Bandar Bayan Baru, Pulau Pinang, 11950, Malaysia |

| Kota Kinabalu, Sabah | Lorong Api Api, Kota Kinabalu, Sabah, 88000, Malaysia. |

| Kuching, Sarawak | Green Heights Commercial Centre, Kuching, Sarawak, 93250, Malaysia. |

💬 How can I ensure my 2026 trust setup is both protected and tax-compliant?

Addressing real-world questions about Section 82B, MITRS reporting, and the latest 2026 Budget incentives for Malaysian families and business owners.