NVIDIA Groq AI: Nvidia’s Strategic Acquisition Marks Significant Growth in AI Chip Industry

In a landmark transaction announced from Washington, NVIDIA Groq AI has drawn attention. Nvidia Corporation agreed to acquire assets from Groq, a startup specialising in high-performance artificial intelligence accelerator chips. The deal is valued at approximately US$20 billion in cash.

This acquisition represents the largest purchase ever made by Nvidia. It significantly surpasses the company’s previous US$7 billion acquisition of Mellanox in 2019. Alex Davis, CEO of Disruptive, disclosed the deal. Disruptive has participated extensively in Groq’s financing since its inception in 2016.

The development arrives amid rising interest and competition in the semiconductor sector. This trend is visible in regions including Malaysia and areas such as Selangor. Engineering and safety sectors there continue to monitor advances linked to AI and infrastructure development.

NVIDIA Groq AI: Acquisition Process Accelerated by Groq’s Rising Valuation

Groq recently completed a US$750 million funding round. The round valued the company at close to US$6.9 billion. Major investors included BlackRock, Neuberger Berman, Samsung, Cisco, Altimeter, and 1789 Capital. Donald Trump Jr. is a partner at 1789 Capital.

According to Davis, the purchase process came together swiftly. Nvidia moved quickly to secure Groq’s assets. Groq’s cloud division, GroqCloud, remains excluded from the transaction and continues operations.

Groq CEO Jonathan Ross and president Sunny Madra will transition to Nvidia. Other senior personnel will also join. Their role will focus on developing and scaling the licensed technology. Groq will continue operating as an independent company. Finance head Simon Edwards will assume the role of CEO.

Official positions confirm transactional details without further comment on integration

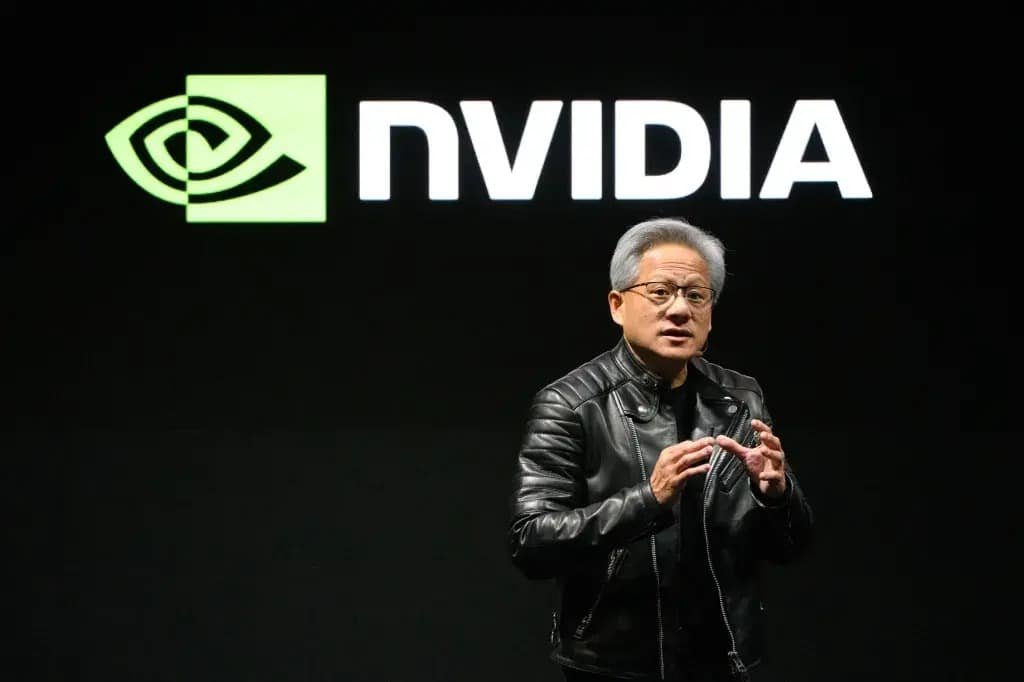

Nvidia’s Chief Financial Officer, Colette Kress, declined to comment publicly on the transaction specifics. However, an internal email obtained by CNBC provided further clarity. Nvidia CEO Jensen Huang explained that the deal would enhance Nvidia’s AI capabilities.

Huang stated that Nvidia plans to integrate Groq’s low-latency processors into its AI factory architecture. The move aims to strengthen AI inference and real-time processing capabilities. He clarified that Nvidia is licensing Groq’s intellectual property and onboarding key talent. Nvidia is not acquiring Groq as an operating company.

The deal excludes GroqCloud, which is expected to continue without disruption. This structure aligns with Nvidia’s previous strategy. In a prior case, Nvidia completed a US$900 million deal involving AI hardware startup Enfabrica without full corporate absorption.

Industry observers note broader trends in AI talent acquisition and investment

The Nvidia–Groq agreement emerges amid intensified competition for AI talent. Technology giants such as Meta, Google, and Microsoft have pursued similar acquisition and licensing strategies. Nvidia has also expanded investments across the AI hardware ecosystem. These include support for companies such as Crusoe, Cohere, and CoreWeave.

Nvidia has signalled plans to invest up to US$100 billion in OpenAI. It has also announced a separate US$5 billion partnership with Intel. These moves reflect an aggressive posture in AI innovation.

Groq’s rise highlights competitive dynamics in AI chip development. The company was founded by former Google engineers, including Jonathan Ross. Ross was one of the creators of Google’s tensor processing unit (TPU). Other AI chip startups, such as Cerebras Systems, have faced volatility. Some have delayed IPO plans despite raising large amounts of capital.

Short and long-term implications expected in AI accelerator chip markets and engineering practices

In the short term, the US$20 billion acquisition may influence market dynamics. It consolidates key AI hardware technology under Nvidia’s control. This shift could affect competition, supply chains, and investment flows across the semiconductor industry.

Indirect effects may appear in regions such as Malaysia. Areas including Seri Kembangan and Batu Caves may gradually integrate AI-enabled technologies. These developments often rely on advanced chipsets for traffic management and safety systems.

Over the long term, integrating Groq’s low-latency processors may advance real-time AI inference. This progress could foster innovation across multiple sectors. The transaction also signals a shift toward strategic licensing arrangements. Such models balance technological advancement with operational independence for specialised startups.