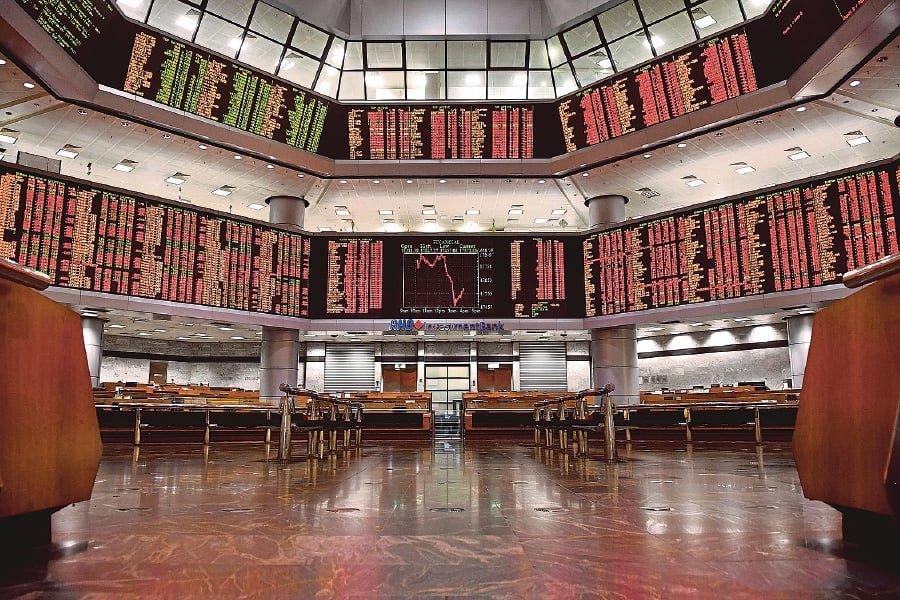

The trading floor buzzed as screens flashed numbers relentlessly, traders calling out prices, fingers hovering over keyboards. Malaysia stock today saw a lift, led by strong gains in banking shares. The FTSE Bursa Malaysia KLCI (FBM KLCI) climbed 1.90 points to close at 1,610.95, maintaining its position above the 1,610 threshold. Intraday, the index briefly hit 1,613.53 before easing back, stabilizing after lunch. Meanwhile, the FTSE All-Share Index slipped 5 points to 11,988.44, and the ACE Market fell 10.60 points to 5,189.86.

Malaysia Stock Today: Banking Shares Drive Market Momentum

Banking stocks Malaysia were the main driver. CIMB stock price today rose 12 sen to RM7.37, Maybank latest stock price climbed 2 sen to RM9.91, and RHB Bank stock trend added 6 sen to RM6.63. Among other notable movers, Petronas Chemicals (PCHEM) lost 20 sen to RM4.35, PPB Group slipped 12 sen to RM10.00, while Vant Energy (VANTNRG) surged 3.5 sen to 56.5 sen, an 8% increase. Market activity was subdued overall, with 459 stocks rising, 645 declining, and 487 unchanged. Total trading volume reached 3.77 billion shares, worth around RM2.47 billion. Top Malaysian stocks today included EA Holdings (EAH), leading with 232 million shares traded, closing flat at 0.5 sen, while MTOUCH Technology remained active at 6.5 sen.

IPO surge: How the Malaysian IPO market is shaping investor interest

The Malaysian IPO market kept its momentum. JS Solar (JSSOLAR) rose 2.5 sen to 42 sen, while Xpress Power (XPB) fell 0.5 sen to 21.5 sen. Prospectuses from THMY Holdings and Verdant Solar Holdings indicate continued investor interest, providing options for those tracking Malaysian stocks closing points and Today Malaysian stocks performance.

Tracking trends: Malaysia stock today amidst global market movements

Global markets influenced sentiment. U.S. stocks ended higher last Friday, with the Dow Jones up 0.65%, the S&P 500 rising 0.59%, and Nasdaq up 0.44%. Malaysian stock market trends mirrored mixed Asian performances: Hong Kong’s Hang Seng surged 1.89%, Shanghai Composite rose 0.90%, South Korea’s index gained 1.33%, while Taiwan’s TAIEX fell 1.70% and Japan’s Nikkei 225 dropped 0.69%. Commodities and forex also impacted Bursa Malaysia today. December crude palm oil futures dipped RM12 to RM4,384 per ton. The Malaysian Ringgit was quoted at 4.2150 against the U.S. dollar and 3.2672 against the Singapore dollar. Investors tracking Malaysian stock market today might note the influence of these factors on trading sentiment.

Eyes on the Market: Where to Next?

With banking stocks leading and IPO activity heating up, investors should track Malaysia stock today, monitor top movers, and consider global trends to navigate potential opportunities and risks in Bursa Malaysia.

-300x300.png)